WHAT IS CAR INSURANCE?

Car insurance acts as a protective shield against theft, monetary losses due to accidents and any other subsequent liabilities. A comprehensive car insurance plan consists of three components - the mandatory third party cover, the own damage cover and personal accident cover.

But before we get to explaining those components in detail, it is important to understand what factors affect car insurance premiums.

5 Factors That Determine Car Insurance Premiums

The premium is the most important component of your insurance. The premium for your car insurance depends on the following factors:

- Insured Declared Value (IDV): The IDV is the maximum amount of sum assured that you can claim from your insurer, for a damaged or stolen car. Your IDV may vary depending on the ex-showroom price and depreciation of your car. So, the older your car gets the lower the IDV.

- Car Model: Your premium will vary based on how expensive your car is. More expensive cars with a higher engine capacity (exceeding 1500cc), like luxury sedans and SUVs, will have higher premiums, while base car models with lower engine capacity (below 1500cc) will have lower premiums.

- Age of Car: Since the IDV changes with the age of your car, age is also an important factor in determining car premium. As your car gets older, its IDV depreciates which leads to lower premiums.

- Car Safety: Another major factor affecting your car insurance premium is how safe your car is. Insurance premiums for cars with advanced safety features will be lower than those without such features. This is because safety features like airbags, ABS, collision warning systems, anti-theft alarms, and automatic braking make your car less susceptible to theft and accidents.

- Location of Car: The registration address of your car also determines your car insurance premium. Car insurance purchased at locations with higher crime and accident rates will have higher premiums as the car becomes more susceptible to theft or damage in such areas. This makes car insurance costlier in urban areas than rural ones, as crime and accident rates are usually higher in urban areas.

Third-party, Own-Damage & Personal Accident Covers in a Car Insurance Premium

Motor insurance plans shield you from monetary losses that may arise in case your car gets damaged due to some unforeseen event. You need to pay a small premium to the insurance company every year to claim this benefit if and when it arises.

Your car insurance premium is the sum total of the following 3 covers:

1.Third Party Cover

Any damage to a person or property by your insured vehicle that results in financial loss or loss of life is covered under Third-Party Liability (TPL). In India, it is mandatory to have a TPL cover if you own a car. As TPL does not cover expenses borne by you for any repairs, it is always prudent to opt for a policy that extends its coverage to include losses on account of damage to your vehicle. The TPL premium rate is based on the car’s engine capacity. The table given below for TPL rates(Financial year 2019-20 ) is issued by the Insurance Regulatory Authority of India (IRDA):

Annexure A - Motor Third Party Liability Insurance Premium for the Financial Year 2019-20 effective from 16th June 2019

Table 1:

| S. No. |

Category |

Description of Vehicle Class |

Premium with effect from 16th June 2019 (Rs.) |

| 1. |

|

Private Cars* |

|

| |

|

Not exceeding 1000 cc |

Rs. 2,072 |

| |

|

Exceeding 1000 cc but not exceeding 1500 cc |

Rs. 3,221 |

| |

|

Exceeding 1500 cc |

Rs. 7,890 |

| |

|

|

|

| 2. |

|

Two Wheelers |

|

| |

|

Not exceeding 75 cc |

Rs. 482 |

| |

|

Exceeding 75 cc but not exceeding 150 cc |

Rs. 752 |

| |

|

Exceeding 150 cc but not exceeding 350 cc |

Rs. 1,193 |

| |

|

Exceeding 350 cc |

Rs. 2,323 |

| |

|

|

|

| 3. |

A1 |

Goods Carrying Vehicles Public Carriers (other than 3 wheelers) |

|

| |

|

GVW not exceeding 7500 kgs |

Rs. 15,476 |

| |

|

Exceeding 7500 kgs but not exceeding 12000 kgs |

Rs. 26,935 |

| |

|

Exceeding 12000 kgs but not exceeding 20000 kgs |

Rs. 33,418 |

| |

|

Exceeding 20000 kgs but not exceeding 40000 kgs |

Rs. 43,037 |

| |

|

Exceeding 40000 kgs |

Rs. 41,561 |

| |

|

|

|

| 4. |

A2 |

Goods Carrying Vehicles Private Carriers (other than 3 wheelers) |

|

| |

|

GVW not exceeding 7500 kgs |

Rs. 8,438 |

| |

|

Exceeding 7500 kgs but not exceeding 12000 kgs |

Rs. 17,204 |

| |

|

Exceeding 12000 kgs but not exceeding 20000 kgs |

Rs. 10,876 |

| |

|

Exceeding 20000 kgs but not exceeding 40000 kgs |

Rs. 17,476 |

| |

|

Exceeding 40000 kgs |

Rs. 24,825 |

| |

|

|

|

| 5. |

A3 |

Goods Carrying Motorized Three Wheelers and Motorized Pedal Cycles – Public Carriers |

|

| |

|

Except e-carts |

Rs. 4,092 |

| |

|

e-carts |

Rs. 2,859 |

| |

|

|

|

| 6. |

A4 |

Goods Carrying Motorized Three Wheelers and Motorized Pedal Cycles – Private Carriers |

|

| |

|

Except e-carts |

Rs. 3,914 |

| |

|

e-carts |

Rs. 3,204 |

| |

|

|

|

| 7. |

B |

Trailers |

|

| |

|

Agricultural Tractors up to 6 HP |

Rs. 857 |

| |

|

Other vehicles including Miscellaneous & Special Type of Vehicles (Class-C), (For each trailer, for more please multiply by no. of trailers) |

Rs. 2,341 |

| |

|

Except e-carts |

Rs. 3,914 |

| |

|

e-carts |

Rs. 3,204 |

| |

|

|

|

| 8. |

D |

Special Types of Vehicles |

|

| |

|

i) Pedestrian controlled Agricultural Tractors with Horse Power rating not exceeding 6HP, Hearses and Plane Loaders |

Rs. 1,550 |

| |

|

ii) Other Miscellaneous & Special types of vehicles |

Rs. 6,847 |

| |

|

e-carts |

Rs. 3,204 |

| |

|

|

|

| 9. |

E |

Motor Trade (Road Transit Risks) |

|

| |

|

i) Distance not exceeding 2400 kms |

Rs. 1,055 |

| |

|

ii) Distance exceeding 2400 kms |

Rs. 1,268 |

| |

|

|

|

| 10. |

F |

Motor Trade (Road Risks) (Excluding Motorized Two Wheelers) – (Named Driver or Trade Certificate) |

|

| |

|

1st named driver or certificate |

Rs. 1,345 |

| |

|

For additional drivers/ certificates up to 5 (per driver/certificate) |

Rs. 651 |

| |

|

For additional Drivers/ Certificates exceeding 5 but not exceeding 10 (per driver/ certificate) |

Rs. 419 |

| |

|

For additional Drivers/ Certificates exceeding 10 but not exceeding 15 (per driver/ certificate) |

Rs. 363 |

| |

|

|

|

| 11. |

F |

Motor Trade (Road Risks) (Motorized Two Wheelers) – (Named Driver or Trade Certificate) |

|

| |

|

1st named driver or certificate |

Rs. 515 |

| |

|

For each additional Driver/ Certificate |

Rs. 257 |

*Vintage cars: 50% discount applicable for all private vehicles categorized under the 'Vintage Cars' segment. Certification by the Vintage & Classic Car Club of India is required for classification.

Table 2

| S. No. |

Category |

Description of Vehicle Class |

| Premium with effect from 16th June 2019 (Rs.) |

| Basic TP Premium (A) |

Premium (per licensed passenger) (B)# |

|

| 12. |

C1a |

Four wheeled vehicles used for carrying passengers for hire or reward with carrying capacity not exceeding 6 passengers |

|

|

| |

|

Not exceeding 1000 cc |

Rs. 5,769 |

Rs. 1,110 |

| |

|

Exceeding 1000 cc but not exceeding 1500 cc |

Rs. 7,584 |

Rs. 934 |

| |

|

Exceeding 1500 cc |

Rs. 10,051 |

Rs. 1,067 |

| |

|

|

|

| 13. |

C1b |

Three wheeled vehicles used for carrying passengers for hire or reward with carrying capacity not exceeding 6 passengers |

|

|

| |

|

Except e-rickshaw cc |

Rs.2,595 |

Rs. 1,241 |

| |

|

e-rickshaw |

Rs. 1,685 |

Rs. 806 |

| |

|

|

|

| 14. |

C2 |

Four or more wheeled vehicles used for carrying passengers with carrying capacity exceeding 6 passengers for hire or reward |

|

|

| |

|

School buses$ |

Rs.13,874 |

Rs. 848 |

| |

|

Other buses |

Rs. 14,494 |

Rs. 846 |

| |

|

|

|

| 15. |

C3 |

Motorized three wheeled passenger vehicles used for carrying passengers for hire or reward with carrying capacity exceeding 6 passengers but not exceeding 17 passengers |

Rs. 6,913 |

Rs. 1,379 |

| |

|

|

|

| 16. |

C2 |

Three wheeled passenger vehicles used for carrying passengers for hire or reward with carrying capacity exceeding 17 passengers |

Rs. 15,845 |

Rs. 969 |

| |

|

|

|

| |

C4 |

Motorized Two wheelers used for carrying passengers for hire or |

|

|

| |

|

|

|

| 17 |

|

reward |

|

|

| |

|

Not exceeding 75 cc |

Rs.861 |

Rs. 580 |

| |

|

Exceeding 75 cc but not exceeding 150 cc |

Rs.861 |

Rs. 580 |

| |

|

Exceeding 150 cc but not exceeding 350 cc |

Rs.861 |

Rs. 580 |

| |

|

Exceeding 350 cc |

Rs.2,254 |

Rs. 580 |

# TP Premium is the total of Basic TP Premium (A) plus an amount derived by multiplying the Licensed carrying capacity by the amount in (B).

$ School Buses are those buses which are registered in the name of the School and are used only for Transporting students to or from a school or on school related trips.

Table 3 - Long Term Premium Rates

| S. No. |

Category |

Premium with Effect from June 16, 2019 (Rs.) |

| 18. |

New Private Car - 3 Year Single Premium |

|

| |

Not exceeding 1000 cc |

Rs. 5,826 |

| |

Exceeding 1000 cc but not exceeding 1500 cc |

Rs. 9,534 |

| |

Exceeding 1500 cc |

Rs. 24,305 |

| 19. |

New Private Car - 3 Year Single Premium |

|

| |

Not exceeding 75 cc |

Rs. 1,045 |

| |

Exceeding 75 cc but not exceeding 150 cc |

Rs. 3,285 |

| |

Exceeding 150 cc but exceeding 350 cc |

Rs. 5,453 |

| |

Exceeding 1500 cc |

Rs. 13,034 |

Table 4 - Rates for Electric Private Cars & Two Wheelers

| S. No. |

Category of Vehicle |

| PPremium with effect from 16th June 2019 (Rs.) |

| One Year Policies |

Long- Term Policies |

|

| 20. |

Private Cars |

|

|

| |

Not Exceeding 30 KW |

Rs. 1,761 |

Rs. 4,493 |

| |

Exceeding 30 KW but not exceeding 65 KW |

Rs. 2,738 |

Rs. 8,104 |

| |

Exceeding 65 KW |

Rs. 6,707 |

Rs. 20,659 |

| 21. |

Two Wheelers |

|

|

| |

Not Exceeding 3 KW |

Rs. 410 |

Rs. 888 |

| |

Exceeding 3 KW but not exceeding 7 KW |

Rs. 639 |

Rs. 2,792 |

| |

Exceeding 7 KW but not exceeding 16 KW |

Rs. 1,014 |

Rs. 4,635 |

| |

Exceeding 16 KW |

Rs. 1,975 |

Rs. 11,079 |

Table 5 - Rates for Quadricycle

| Category |

| Premium with effect from 16thJune 2019 (Rs.) |

| Basic TP Premium (A) |

PPremium (per licensed passenger) (B)# |

|

| Quadricycle (Private Cars) |

Rs. 2,072 |

N/A |

| Quadricycle (Commercial Vehicles not exceeding 500 CC) |

Rs. 2,595 |

RS. 1,241 |

# TP Premium is the total of Basic TP Premium (A) plus an amount derived by multiplying the Licensed carrying capacity by the amount in (B)

Own Damage Cover

The Own Damage or OD cover is optional but highly beneficial. It provides reimbursements in case your car is damaged due to any natural events like earthquakes, fire, storms, etc. or due to any man-made calamities or any external accidents. The premium for an OD cover is calculated as a percentage of Insurance Declared Value or IDV (market price of your car less depreciation, as per the chart is given below).

The thumb rule is that the more the IDV, the higher the premium and vice versa. Also remember that as your car grows older, the IDV decreases.

| Age of Vehicle |

% of Depreciation (as per Indian Motor Tariff) |

| Up to 6 months |

5% |

| 6 months to 1 year |

15% |

| 1-2 years |

20% |

| 2-3 years |

30% |

| 3-4 years |

40% |

| 4-5 years |

50% |

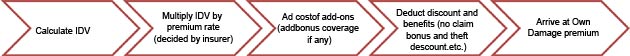

Procedure for Calculating Own Damage Premium

Doing detailed calculations can help customers manage their premiums effectively and on time. Below are the key steps in calculating your OD premiums:

- Calculate IDV- IDV is the insured declared value which the consumer receives in case of theft or total loss of the vehicle. IDV is calculated on the basis of the selling price and the deductions due to the depreciation of the vehicle’s parts. One can find this by the below formula

Insured Declared Value = (Company’s listed price – the depreciation value) + (Cost of vehicle accessories - the depreciation value of these parts)

- Multiply IDV by premium rates- This is the rate at which the premium is payable and depends on geographical locations, cubic capacity (capacity of the vehicle engine), and age of the vehicle. The premium rates are comparatively higher for Tier I cities than Tier II and Tier III cities.

- Adding bonus add ons- It is advisable for customers to check for any add-ons that they can avail on their premiums. Some of the primary add-ons are:

- Zero depreciation or Bumper-to-Bumper cover

- Engine protect cover

- Consumables cover

- Return to invoice cover

- NCB protect cover

- Deduct any discounts- Check for NCB (No-Claim bonus) which is available if no claims are made in the previous year. NCB can get accumulated over the years and go up to 50%. In addition to NCB, there are some prescribed discounts are also available on Own Damage premium that includes Installation of anti-theft devices, membership of Automobile Association of India, opting for voluntary deductible/excess, etc.

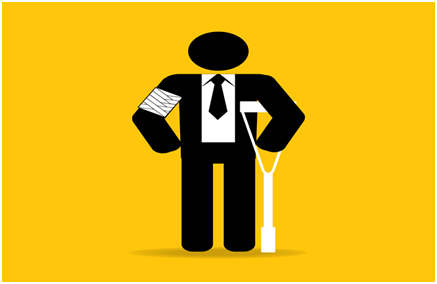

Personal Accident Cover

The last component of your car insurance premium is the Personal Accident Cover. This cover safeguards your finances in the unfortunate event a fatal accident occurs that renders you permanently or partially disabled. A compulsory personal accident cover is provided to the owner-driver.

However, one may increase the sum insured and also include unnamed passengers in the policy. The higher the sum insured, the higher the personal accident premium to be paid.

You can make this process simpler by using an online car insurance premium calculator. All you need to do is fill out your details in an online calculator; these are available on the websites of all leading insurance providers like ICICI Lombard.

Many buyers do not take into account the details of the insurance premium at every renewal and head straight for making a payment. Take your time to research and make an informed choice regarding the car insurance policy you need.