Travelling cross-country and across the globe, ironically, often instills a greater sense of wanderlust within us. Seldom do we wake up to hissing sounds of glistening waterfalls or living as a carefree hermit in a forest-camped tent. Experiencing different cultures, relishing cuisines from around the world, and looking at a collage of nature's best offerings are just a few of the most amazing things you can be greeted with while globe-trotting. However, not all trips go as planned; if, god forbid, some disaster befalls you before/during your journey, a travel insurance policy will always come in handy. Given below are the pointers to consider while claiming your travel insurance.

|

|

|

|

|

|

|

|

Carry important documents

Bringing along important documents for your excursion is as essential as carrying your clothes. Pack each necessary document in case you need to make a travel insurance claim. Your policy number along with contact numbers of claim lines is important to keep handy; keeping the 24-hour emergency assistance number is also of utmost importance.

|

|

|

|

Call your insurer

Promptly contacting your insurer is imperative if you think you might need to claim travel insurance. This must be done as quickly as possible even though the insurer usually gives you a bandwidth of 31 days; this is because you might need the insurer's authorization prior to any medical treatment taken abroad. Details of the incident occurred must be given to the insurer, following which they will send you a claim form to fill up.

|

|

|

|

|

|

|

|

"Call 911!" (or that country's Police helpline)

If you happen to be the victim of any crime or theft, it behooves you to call the cops. Whether or not they are able to catch the robbers or retrieve the stolen items, they will definitely help by providing the vital information to your insurer, which will in turn facilitate speedy possession of your claim.

|

|

|

|

Give the insurer what he wants! (evidence)

An insurer will not provide you with a claim without any evidence to substantiate the cause. For instance, if you cancel your trip due to ill health, your general practitioner will have to support you by providing the insurer with complete medical form. On the other hand, in case of theft, you have to submit a receipt of purchase/ownership as proof that the items belong(ed) to you. Make sure you pick up a 'baggage irregularity form' in case of lost baggage on the aircraft or airport.

|

|

|

|

|

|

|

|

Honesty is the best policy. Seriously!

Makesure you claim your insurance only in a genuine case; do not make a false claim as it might land you into trouble as well as increase the premium amount.

|

|

|

|

Claim limit

The policy pays only up to a certain amount in the event of a claim; the amount paid depends on the type of incident occurred. For instance, medical bills can get you a higher claim than lost luggage (details of which are provided in the policy). Also, 'conditions apply' of course.

|

|

|

|

|

|

|

|

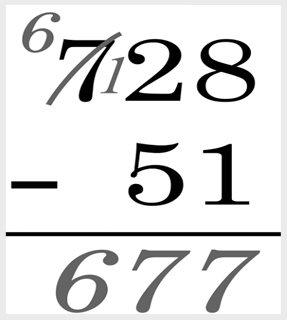

Excess

No, the policy does not pay in excess of what it has to. The policy excess is the amount you have to pay towards each claim. For instance, if the claim is for Rs. 1,00,000 and the excess is Rs. 10,000, the insurer will pay Rs. 90,000. It is advisable to pay the bill yourself if the amount is a small one.

|

|

|

|

Disclaimer: Insurance Awareness initiative. ICICI Lombard General Insurance Company Limited, ICICI Lombard House, 414, Veer Savarkar Marg, Prabhadevi, Mumbai - 400025. IRDA Reg. No. 115. Toll Free 1800 2666 Fax no - 022 61961323. Email us at customersupport@icicilombard.com Visit www.icicilombard.com CIN: (U67200MH2000PLC129408). EC014AA1888IA

|