Third Party Cover - What Is It?

Third party insurance policies are mandatory as per the Motor Vehicle Act, 1988. All car owners in India need to have this insurance. It financially safeguards third parties against damages caused by the car owner. The beneficiary in a third party cover happens to be an individual other than the parties linked with the contract (the insurance company, subcontractor, vendor, supplier or the car owner). The plan essentially covers:

- Injury or death to a person due to your vehicle

- Damage to property or any other person due to your vehicle

Note: Third Party Insurance does not cover the owner and his motor vehicle. The plan provides a cover of Rs 7.5 Lakhs for private cars and Rs 1 Lakh for two-wheelers.

Own Damage Cover-What Is It?

An insurance plan that protects the car owner from monetary losses due to any damage to his own vehicle is commonly referred to as 'Own Damage' Insurance. This reimburses the car owner for any car repair or maintenance due to external causes like fire, explosion, burglary, theft, terrorist activity, storms, landslides, etc. This policy offers to cover all the possible financial risks involved with vehicle ownership.

Personal Accident Cover-What Is It?

Comprehensive car insurance plans provide the owner and passengers with a personal accident cover up to Rs. 2 Lakhs. The cover reimburses accident related hospital expenses and offers a lump sum amount in case of accidental death or permanent total disability.

How is Car Insurance Premium Calculated?

Premiums for all three covers (Third Party, Own Damage, and Personal Accident) are calculated separately to arrive at the total car insurance premium amount.

How is Third Party Premium Calculated?

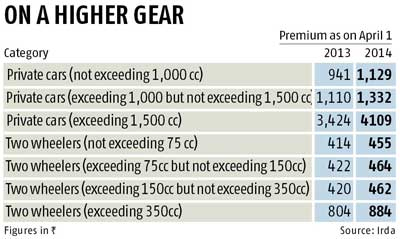

It is computed on the basis of rates provided by the authorities of Tariff Advisory Committee, which is an arm of the IRDA. The premium for each year is calculated on the basis of the previous year's claim data, after adjustments for inflation. As per the latest directive issued in March 2014, there has been a steep hike in the premiums for the period 2014-2015:

How is Own Damage Premium Calculated?

Premium for Own Damage Insurance is calculated by insurance companies on the basis of IDV (Insured Declared Value) i.e. the ex showroom price of your car less depreciation. IDV is NOT the purchase price of your car. It depends on the age and depreciation or wear and tear of your vehicle.

The Depreciation Table for calculating the IDV:

Age of Your Vehicle

|

Depreciation Rate for calculating the IDV

|

0 - 6 months

|

5%

|

6 m - 1 year

|

15%

|

1 year - 2 years

|

20%

|

2 years - 3 years

|

30%

|

3 years - 4 years

|

40%

|

4 years - 5 years

|

50%

|

Notes:

1. If your car is more than five years old, you need to mutually decide the IDV with your insurance company.

2. The amount of your insurance claim can be either lesser than or equal to the IDV. Hence it is always beneficial to have an IDV near the current market price of your car.

No Claim Bonus (NCB)

You are awarded bonus for driving safely and not claiming insurance. This is known as NCB – No Claim Bonus. The amount of NCB is deducted from the premium amount.

Other Factors

Other factors that have a bearing on the Own Damage premium are class of vehicle, cubic and seating capacity (higher the cubic capacity, greater will be the premium payable), discounts, add-ons opted for and past claims experience of the company; along with the details of the driver like age, gender, license validity and so forth.

Next time around don't be stumped at the premium chart. You can now demystify your premium amount!

|