Home Insurance or homeowner's insurance is a type of property insurance to cover losses against private residences. A comprehensive home insurance policy is a combination of other policies and protects the structure, contents and losses due to other accidents in the home.

Home insurance policies are usually valid for a fixed period, for which the homeowner or insured pays the insurer a premium. The value of the premium varies depending on the potential risks associated with the home and the necessary precautions adopted for protection of the home. Homes are usually susceptible to fire, natural disasters, terrorist attacks, burglary, etc.

History of Home Insurance

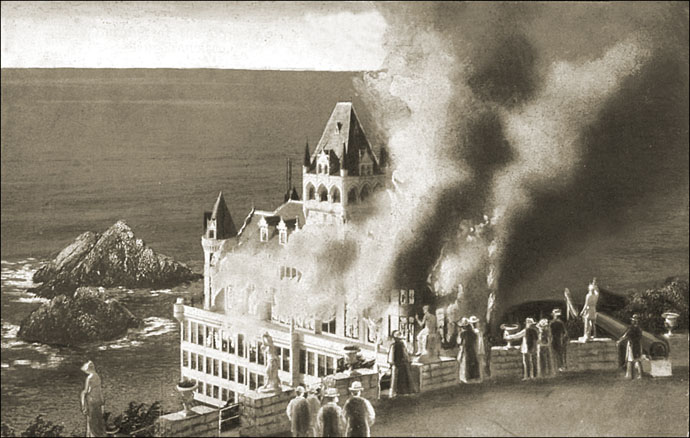

The relevance of property insurance increased with the Great Fire of London in 1666, which destroyed almost 13,000 houses. The earliest policies that were introduced were primarily fire insurance policies for protection against losses from fire, since that was the major risk to homes, especially in crowded European cities. These policies were opted only by the upper classes of society.

In the subsequent years, insurance companies expanded their offerings to include other forms of damage. The first comprehensive home insurance policy is considered to have been introduced in 1950 in the US, prior to which separate policies had to be purchased for separate risks.

Indian Scenario

The Insurance Regulatory and Development Authority of India (IRDAI) is the apex body that governs the functioning of the Indian insurance sector. Home insurance falls under the General Insurance category. Several companies offer comprehensive home insurance. In India, government-owned as well as private insurance companies offer user-friendly insurance schemes and world-class services. The claims procedure is also streamlined, transparent and hassle-free.

Insurance has gone digital and India is gearing up for this revolution. Insurance seekers can now avail insurance related information at their fingertips and take an informed decision. Higher Internet penetration has contributed in making insurance accessible to everyone through various web and mobile platforms. You can now easily renew your insurance policy at the click of a button. Online insurance has made it extremely convenient for people to avail and renew their insurance policies. This has increased insurance policy purchasing trends, especially among the Indian youth.

Types of Home Insurance in India

Home insurance in India covers two aspects, structure of the home and contents in the home. Thereby, home insurance is of two types:

Structure Insurance - It covers the losses due to structural damage of the home from natural calamities such as earthquakes, floods, etc., manmade calamities and terrorist attacks.

Content Insurance - It covers the loss or damage of contents inside a home such as electronics, jewellery, furniture, etc. and the coverage is usually on the market value of the contents.

It is important to note that structure insurance covers only the building and not the property or land surrounding it. Also, loss of precious articles such as jewellery, etc. is covered only if they are safely stored under lock and key.

Critical Aspects of Home Insurance

A home is usually one of the biggest financial investments in an individual's life. Therefore, safeguarding it is critical. Here are some important aspects of home insurance:

Type of Policy

Based on your nature of association with the home, you can choose the insurance policy that is adequate for you. For homeowners, it is advisable to opt for a structure insurance to protect your building. If you are a homeowner living in your own home, it is wise to opt for a comprehensive home insurance cover that covers both the structure and contents of your home.

For tenants, a content insurance policy is recommended while it is considered that the owner has purchased the structure insurance.

Many homes may be covered under group property insurance purchased by the builder or developer. However, this covers the losses of individual homes only to a certain extent and may not be adequate for individual needs.

Sum Insured

Structure Insurance - Here, the sum insured is the amount required to reconstruct the house on the current day. It is not the market value of the house; it is the reconstruction value or reinstatement value.

Content Insurance - Here, the sum insured is calculated by deducting the depreciation of the article from its market value. Therefore, it is not the replacement value, it the value of the article after considering its age.

Home Insurance Premium

Sum insured for the home insurance policy is calculated after considering the (built-up area, the re-construction cost per square unit of area and the value of contents in the home after depreciation. It is calculated as:

Sum Insured = (Built-up area (sq. ft.) X Construction cost/sq. ft.) + Value of contents after depreciation

The premium is determined by other factors such as:

• Layout of the house and construction materials

The design of the house and the infrastructure such as indoor swimming pool, materials used in construction e.g. marble floor, etc. influence the premium.

• Location

The location of the house is a critical factor that influences the policy premium. Houses that are located in earthquake-prone areas, areas with high crime rate, etc. will usually be insured at a higher premium.

With the provision of buying insurance online, insurance companies offer online premium calculators for convenience. In order to use this calculator, details like the built-up area of the home, construction cost per square unit in the locality and value of contents and jewellery need to be kept handy.

Review and Renew

Ensure to renew your policy before it expires, for calamities can strike anywhere at any time. Several insurance companies provide reminder option to policyholders to inform them about the policy renewal date. Online renewal is quick and hassle-free.

Policy renewal is also an opportunity to review the policy. While home insurance is not mandatory, unlike motor insurance, it is important to understand the policy before opting for it. The specific needs of your home, the level of cover required for contents, etc. must be addressed before opting for a policy. In addition, since home insurance policies are usually annual, it is essential to review the items covered under the existing policy. It is possible that the circumstances and contents have changed during the period. Similarly, there may be certain add-on covers that are no longer necessary. These can be removed to reduce the premium.

Beyond Home Insurance Premium

Premium rates are only one of the criteria while buying an insurance policy and should not be the only aspect you consider while comparing policies online. Relevant add-ons, services and features offered by the insurance provider, time taken for claim settlement, brand value and user reviews are critical factors to consider while you purchase a home insurance policy.