Indians love their 2-wheelers and the fact that it is the largest producer of 2-wheelers in the world underlines this. It is the preferred mode of transportation for millions of Indians. With rising global crude prices and the Government's decision to deregulate fuel prices and leave them to the whims of global goings-on, many first time car buyers are having second thoughts about their decisions and are either sticking to their old, faithful 2-wheelers or are planning to buy new, better ones. This only augurs well for the robust Indian 2-wheeler market. Let's take a look at some of the interesting facts about this market.

Statistics: 2-wheeler production in India grew by 7% in 2013-14 with 16.9 million units, as compared to 15.7 million units in the previous year. 12.5 million Motorcycles, 3.7 million scooters and 0.7 million mopeds were produced in this financial year. Domestic sales have also seen a 7% growth and companies sold 14.8 million units (as against 13.8 million units) during 2013-14. This roughly translates into a US$ 14 billion industry; without even considering other paraphernalia like suppliers, accessories, dealers, etc.

Gearless Scooters: Although motorcycles command a major share in the market, the rise in the popularity of the gearless scooters is astounding. This segment posted an astonishing 25% growth from the previous year in 2011-12. This popularity can be attributed to heavy traffic conditions in cities and such scooters are very popular with college-going girls and working women. The most popular scooter is Honda’s Activa, which sells more than 100,000 units a month. It also has a waiting period of around 10 days to 2 weeks.

Gearless Scooters: Although motorcycles command a major share in the market, the rise in the popularity of the gearless scooters is astounding. This segment posted an astonishing 25% growth from the previous year in 2011-12. This popularity can be attributed to heavy traffic conditions in cities and such scooters are very popular with college-going girls and working women. The most popular scooter is Honda’s Activa, which sells more than 100,000 units a month. It also has a waiting period of around 10 days to 2 weeks.

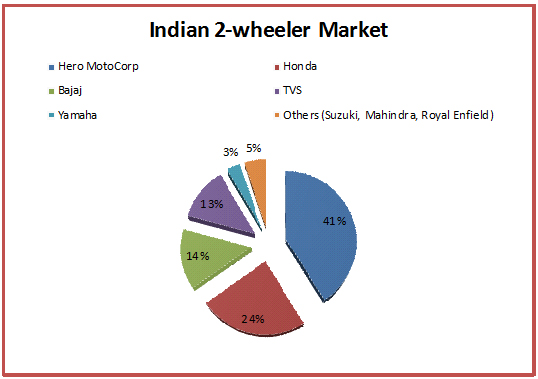

Major Players: Hero MotoCorp still leads the pack with a 41% market share but the major overhaul was seen in the second spot, where Honda has dislodged Bajaj from the Number 2 position and now has a 24% market share. These two are followed by Bajaj (at 14%) and TVS (at 12%). Yamaha is at 3% and brands like Suzuki, Mahindra, Royal Enfield make up the remaining 5%.

Rural Sector: The primary demand for motorcycles (entry-level) still comes from the rural sector. So even though the demand for cars might be more on the lines of luxury, the driving force behind a 2-wheeler sale is utility. This is the main reason for the constant rise in the sales of 2-wheelers through the years even when economic conditions were not conducive for growth.

Royal Enfield: The biggest turnaround seen in the Indian 2-wheeler industry was the rebirth of Royal Enfield. The sleeping giant produced, what many perceived as, dour-looking bikes with the brake and gear on the wrong side. But it turned out that its bikes had a cult-like following amongst urban youth and the company capitalised on this and it has seen a surge in its sales, clocking an increase of around 44%. With a waiting period of around 6 to 8 months for its bikes, Royal Enfield has come out of its own ashes like a Phoenix.

Royal Enfield: The biggest turnaround seen in the Indian 2-wheeler industry was the rebirth of Royal Enfield. The sleeping giant produced, what many perceived as, dour-looking bikes with the brake and gear on the wrong side. But it turned out that its bikes had a cult-like following amongst urban youth and the company capitalised on this and it has seen a surge in its sales, clocking an increase of around 44%. With a waiting period of around 6 to 8 months for its bikes, Royal Enfield has come out of its own ashes like a Phoenix.

Bigger Engines: It has been observed that the Indian consumer is showing preference for bigger engines and hence the Average Motorcycle Engine Displacement Index, or AMEDI, has been steadily increasing. It was 111.64 cc in 2012, but increased to 113.36 cc. This also means that there will be an impact on other fitments like disk brakes, electric starters etc.

Growth Story: The Indian 2-wheeler market has grown 18-fold in the last 3 decades. Experts believe that factors like utility, price, low maintenance, fuel efficiency and the condition of Indian roads, apart from rising fuel prices are responsible for this humongous increase.

The Indian Market and the Indian Consumer are probably the toughest to please and with many competitors vying for their attention, this only creates a positive scenario for both.