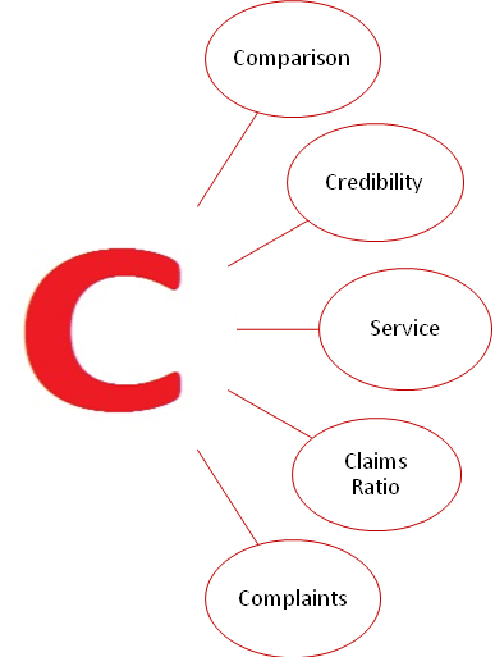

Adopt the 5 C's Approach to zero-in on a health insurance service provider.

Liberalization in India has ensured that there are several health insurance service providers to choose from. The greatest beneficiary is of course the consumer. Choosing the right insurance service provider is as important as selecting the right plan. However, the moot question is - how to go about it? Thankfully, choosing the right insurance company is not rocket science.

You might have heard of the 5 C's of credit. You can also select your insurance company using the 5 C's approach. Here is a brief and simple way to choose your health insurance service provider.

1. Comparative Study

There is no substitute for research. Check the services, prices, inclusion / exclusion and the no. of networked hospitals that the health insurance company has to offer. Some new age insurers also provide value added services like free health check-up, dietician consultations, hospital daily cash, etc.

2. Credibility

You will have a long-term association with your insurance company. Hence, it is prudent to choose an established insurance service provider. Credibility generally comes from being in this field for a number of years. Such companies understand their customers, leading to better services.

3. Customer Service

In the current competitive environment, customer is the king. Health insurance companies are focusing on providing them easy and seamless service.

A Few Quick Tips

Do a comparative study of different insurance policies in the marketplace.

Do a comparative study of different insurance policies in the marketplace.

Contact your friends, co-workers and other acquaintances to collect information about different insurance companies.

Contact your friends, co-workers and other acquaintances to collect information about different insurance companies.

Gather information from sources like Internet reviews, independent insurance websites, etc.

Gather information from sources like Internet reviews, independent insurance websites, etc.

Here are a few parameters to judge the user-friendliness of a health insurance company. -Promptness - How fast do customer care and other officials respond to customer queries? Check their social media pages. -Technological Advancement- Does the health insurance service provider offer easy online buying and renewal options? -Reach - Can you reach customer care on time? -Response - Does customer care respond to mails and queries?

-Promptness - How fast do customer care and other officials respond to customer queries? Check their social media pages. -Technological Advancement- Does the health insurance service provider offer easy online buying and renewal options? -Reach - Can you reach customer care on time? -Response - Does customer care respond to mails and queries?

-Quality - What is the general quality of service? Is it customer-centric?

-Communication - Is customer care able to communicate clearly?

Many health insurance companies provide facilities like setting reminders for renewing insurance. Some of them provide toll free numbers to resolve queries regarding insurance policy.

4. Claim Settlement Ratio

Claims Settlement Ratio is the ratio of the number of claims settled to the number of claims received. A higher ratio indicates you have a higher chance of getting your claim amount.

E.g. suppose an insurance company receives one lakh claims in a year and it settles 98,000. The claims settlement ratio is 98%. This means out of every 100 claims, 98 claims are settled.

Two Quick Points

Do not look at numbers for a particular year. Consider the average claims ratio over three to five years.

Do not look at numbers for a particular year. Consider the average claims ratio over three to five years.

Generally, data on claims ratio can be found in Insurance Regulatory and Development Authority of India (IRDAI) Annual Reports.

Generally, data on claims ratio can be found in Insurance Regulatory and Development Authority of India (IRDAI) Annual Reports.

5. Complaints

You might have heard of the 5 C's of credit. You can also select your insurance company using the 5 C's approach. Here is a brief and simple way to choose your health insurance service provider.

Do not forget to choose the right health insurance service provider to ensure that your financial health is in good shape. health insurance to buy health insurance and protect yourself from the rising cost of healthcare.