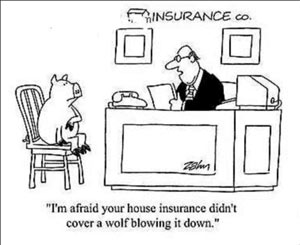

Why end up like the depressed pig here? Be insured. But also be informed.

Go through these do's and dont's of home insurance plans to get more clarity on its nature and extent of coverage.

Do's of Home Insurance

For Beginners

Q. What is home insurance?

A: It is an insurance plan that offers to financially safeguard the policyholder against losses on account of any damage to home or personal belongings at home.

Do choose the right policy

To insure your house, you can opt for structure insurance (covering loss to house), home content insurance (covering loss of personal belongings) or both. Selecting the right policy would depend on your requirement. You can start by assessing factors that pose as a threat to your house. In case you live in a city that has turbulent weather, it makes more sense to buy a cover against storms or floods.

Do understand basis of fixing sum insured

People often get confused in understanding the basis of fixing sum insured. The valuation of your house is based on reinstatement value. This does not involve the market value but focuses on the cost of construction to rebuild the house.

To value contents or possessions under content insurance, market value is used. You will be reimbursed for the cost of buying a similar item of the same age. Do clarify this with your insurance provider, as your claim will depend upon these values.

Do keep ownership/rental documents handy

Keep a copy of the ownership documents or rental agreement of the insured house handy while availing the policy as well as while filing a claim. Ensure to provide adequate and precise information pertaining to the location and value of the house and/or contents. Fill out details accurately, as even a minor mistake could lead to rejections while claiming the insurance.

Don'ts of Home Insurance

Don't pick additional cover randomly

You also have the option to go for additional cover along with your basic policy. Under house insurance, additional covers offered, pertain to loss due to terrorism and coverage of additional expenses of rent for alternative accommodation. Instead of blindly availing the additional covers, weigh the premium with the coverage and make an informed decision.

Don't provide misleading information

People knowingly or knowingly state falsehoods and overvalue their property. What they don’t realize is that this is fraudulent activity is going to come back to haunt them while making a claim. Facts about property and fixtures needs to be stated clearly to avoid disputes at the time of claim.

Don't assume everything is covered

Insurance providers try to provide a comprehensive cover to safeguard your house; however, there are certain exclusions that are not covered under any policy or additional cover. Knowing what is not covered is as important as knowing what is.

Follow the above-mentioned do's and don'ts to ensure that you avail a comprehensive home insurance policy. You can avail one online as well.